When the UK Parliament's select committees dig to discover why a large organisation has failed, they regularly find systemic weaknesses that have been there for years, widely recognised but not by leaders, a time-bomb ticking ’til luck runs out. These canny committees expose leaders who, unchallenged, managed those systems whilst lacking the skill, knowledge and experience required, often pin-pointing character weaknesses, culture and incentives as deeper causes of failure.

When the bomb explodes, most leaders are stunned to discover what outsiders had long been expecting. They don’t miss the warning signs because they are bad but because we humans are wired that way. Cognitive biases lead us to believe that we are better than we really are and cognitive dissonance leaves us unreceptive to news that contradicts our world view.

The UK's politicians seem stuck in that cognitive limbo. We are experiencing the worst failure of government and opposition in living memory. This is not like the departmental disasters described by the Public Accounts Committee. It is far worse. It is the failure of our political system.

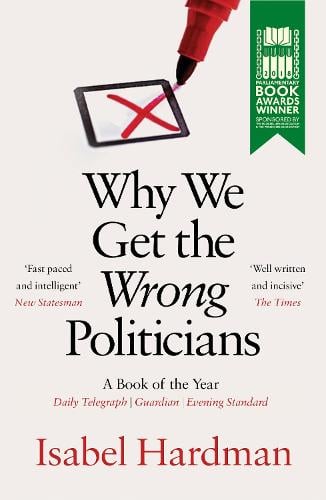

In Why We Get the Wrong Politicians, political journalist Isabel Hardman corrals evidence of what is going wrong in a book that should be compulsory reading for every aspiring and elected politician and civil servant. It is eerie to find so many parallels with my own research into corporate failures. But this is no surprise because all organisational systems are ultimately run by humans.

Analysing MPs’ backgrounds, Hardman finds that few have the knowledge or expertise they need to be effective: “The place is weirdly full of career politicians”. Far fewer have been educated in law, a bizarre weakness in a legislature. Fewer still are well educated in the science and technology that drives the modern world. MPs receive no training on how to navigate the byzantine parliamentary system and its processes. The huge cost of becoming an MP must also reduce diversity of background and perspective.

Analysing MPs’ backgrounds, Hardman finds that few have the knowledge or expertise they need to be effective: “The place is weirdly full of career politicians”. Far fewer have been educated in law, a bizarre weakness in a legislature. Fewer still are well educated in the science and technology that drives the modern world. MPs receive no training on how to navigate the byzantine parliamentary system and its processes. The huge cost of becoming an MP must also reduce diversity of background and perspective.

Hardman describes parliament as “unprofessional”; one MP she interviewed called it “dysfunctional”. She quotes a 2004 pamphlet by Andrew Tyrie: “The executive has succeeded in frustrating parliament… Executive obstructionism and parliamentary weakness threaten to erode trust in politics and politicians, leaving our system of government the biggest casualty.”These traits ensure a blinkered world view and functional incompetence even before the mind-warping Westminster bubble.

Everyone knows that MPs bawl at each other across the floor of the Commons but I was surprised to learn how actively this hubbub is orchestrated. MPs who do not demonstrate unquestioning support for their party find paths towards prestige and power blocked. As to “troublemakers”, the whips reportedly “seek dirt on backbenchers in order to compile as weighty a dossier as possible” against them.

Keeping MPs ignorant, powerless and afraid suits ministers because it shields them from effective challenge. But it is disastrous for democracy and the country.

Just as banks became attractive to people who were driven by the love of money, a culture like this is likely to attract and advance arrogant, amoral egotists with a primal thirst for power more than those with an ethos of diligent public service.

Competence determines what we can do, but character determines what we will do. With MPs selected and rewarded for character traits and behaviour that make them slippery, sycophantic and self-centred, it is no surprise that the public trusts politicians’ truthfulness less than anyone else bar advertising executives. Tyrie’s prediction is now the electorate’s perception.

There is no select committee to force politicians to see their competence, culture, behaviour and mores as others do. The question is: do politicians have the self-awareness to reform themselves before reform is thrust upon them?

Anthony Fitzsimmons is Chairman of Reputability LLP and author of “Rethinking Reputational Risk: How to Manage the Risks that can Ruin Your Business, Your Reputation and You”

This piece was first published in Civil Service World